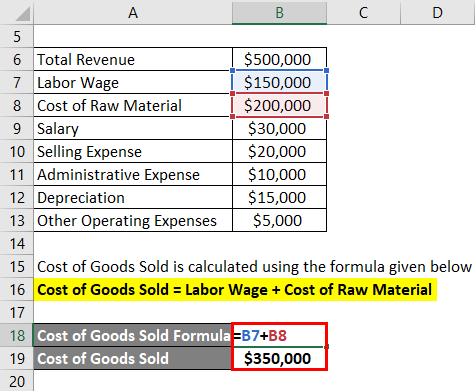

Learn how to calculate it, learn the importance of it and how to use it to your advantage. – Or forced appreciation into the property So, for example, if a property recently sold for $1,000,000 and had an NOI of $100,000, then the cap rate would be $100,000/$1,000,000, or 10%.Īs I said before, as a real estate investor your job is to increase the NOI. It is the rate of return on a real estate investment property based on the income that the property is expected to generate. The capitalization rate, or cap rate, is the ratio of Net Operating Income (NOI) to property asset value. The net operating income is used to determine the CAP Rate, which is then used to find out what the property should be valued at. NOI determines the value of the property. Banks will base the loan amount on if the property can service the debt, meet the loan payments and still have an acceptable monthly cash flow. Property condition and other issues matter, but income is the biggest factor. The lender will evaluate the property based mostly on the income it will generate. When looking at commercial property, the lender is interested in the cash flow from the income. In that case, a bank evaluates the potential person on their ability to pay the mortgage and their history of paying their debt obligations. This is very different from buying a single-family home. An interesting sidenote: investor/owners usually aren’t judged on their credit history because it’s not as important to the lender as the income generating potential of the property to be mortgaged, the NOI. Net operating income = Gross operating income – operating expenses WHAT’S NOI USED FORĬommercial lenders use different qualification criteria to determine if they will give you loan to purchase the property and exactly how much. Subtract the operating expenses from the gross operating income to arrive at the next operating income. There are also expenses that are called above the line and below the line.Ībove the line: What it takes to operate the propertyīelow the line: Big maintenance issues that doesn’t affect the NOI This includes management costs, legal fees, accounting fees, insurance, janitorial, maintenance, supplies, taxes, utilities and any on-going costs that reoccur to keep the property up and running. Now you want to determine the operating expenses of the property. That’s why you subtract the vacancies and any credit loss that you can predict.įollowing trends, and the history of you’re the property will show you the vacancies you can expect as well as the past tenant’s behaviors and actions in paying on time, paying with checks that don’t bounce, etc.

#NOI CALCULATION FULL#

Will you make that? Not likely because you will have some vacancies and issues like tenants not paying their rent on time or the full amount, etc.

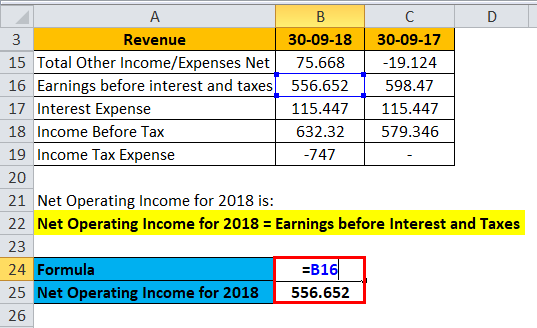

Gross potential income is the income you’d make if every unit in your complex was rented out every day of every year. Gross operating income (GOI) is the gross potential income minus vacancy and credit loss. You must first figure the gross operating income. Net operating income equals all revenue from the property minus all reasonably necessary operating expenses. Net operating income (NOI) is a calculation used to analyze real estate investments that generate income. First, find out how to calculate it and then how to increase it. As a real estate investor, your job is to increase the NOI.

How to Calculate NOI, or Net Operating Income, determines, and drives what you should pay for a deal and the debt you can get.

0 kommentar(er)

0 kommentar(er)